Creating a Calculated Adjusting Journal Entry

Procedures

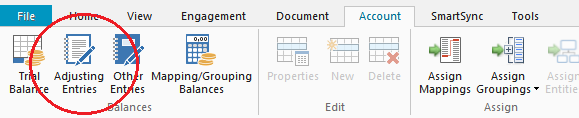

- On the Account tab, in the Balances group, select Adjusting Journal Entry.

- Select the Calculated check box to make a calculation column to appear on the adjusting journal entry interface.

- Click the

button to launch the Calculation Dialog. In this dialog, select a category for the adjustment value.

button to launch the Calculation Dialog. In this dialog, select a category for the adjustment value. - Refine the results in the Results pane by selecting applicable options in the Calculation Dialog.

- Select a value from the list and a corresponding formula will be added to the equation bar. Expressions can contain the following mathematical operations: Addition(+), Subtraction (-) ,Multiplication (*),Division (/). For example, to combine values, add a "+" to the end of the equation bar and select a second value. When selecting a second (or subsequent) value, it is possible to make adjustments to the value parameters. See Numerical Functions for other mathematical functions that can be applied.

Note: You can copy cells from Excel and paste them into the calculation editor. Pasting Excel data in the calculation field will paste the equivalent CVEXCEL() formula as default. Holding the Shift key when pasting Excel data in the calculation field will paste the actual value.

- Use the preview box to verify your value is correct and click

to save the formula.

to save the formula.

Note: If all calculated lines in an entry are blank, then this check-box is automatically cleared.

Example

A calculated eliminating adjusting entry could be created where 2 accounts (101 and 115) are summed and the resulting balance is meant to be eliminated. The formula for this would be -(ACT("YR0","101")+ACT("YR0","115")). Note the minus symbol at the front to give us the opposite sign of the summed amounts. ACT tells Working Papers to look for an account balance, and "YR0" indicates it is the current year to date balance that we are interested in. Working Papers will retrieve the values, sum them, and display them in the adjustment. If an additional adjustment is made to account 101, the calculated adjustment will change accordingly.

Results

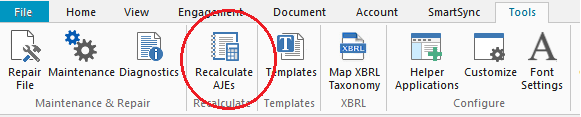

The output of the expression entered in the equation bar will be added to the calculation column on the adjusting entries listing. This formula will be used to calculate the line amount for the adjusting journal entry. Once the calculated adjusting journal entry has been created or changed, the Recalculate button can be used to recalculate all of these entries. All calculated entries for a file can also be updated at once from the Tools ribbon and clicking Recalculate AJE.

Note: Adjusting Journal Entries can also be created directly from the Working Trial Balance and automatic documents.