-- Reference --

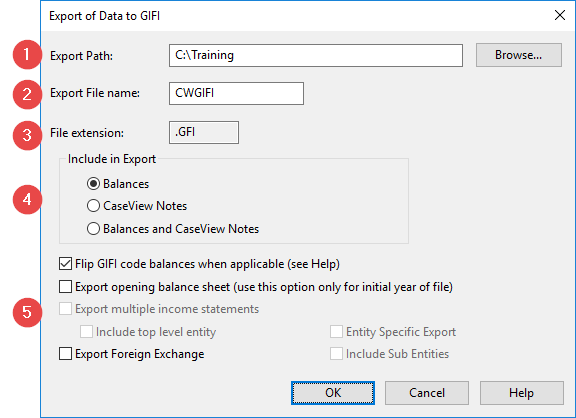

Export of Data to GIFI Dialog

Access: On the Engagement ribbon, click Export | GIFI...

Use this dialog to export Working Papers data as a GIFI text file that you can import into a tax application. This text file should not be used for paper filing. The GIFI numbers and corresponding current year balances will be exported in a comma-delimited file *.GFI.

| Number | Description | |

|

|

Export Path: Enter or click Browse to select a location for the export file. | |

|

|

Export File name: Enter the name of the export file. | |

|

|

File extension: Displays the GIFI file extension (.GFI). | |

|

|

Include in Export: Select which documents to include in the export. To export CaseView notes, you must select the CaseView documents containing those notes by selecting the applicable check boxes in the Select CaseView documents containing financial statements notes dialog. For more information, see Exporting Financial Statement Notes. | |

|

|

Note: Tax adjustments posted directly to tax codes are not affected. Note: The parent company name and address will be included for all tax exports. If exporting entity specific data from a consolidated file, company name and address for sub entities must be modified in the tax software once data has been imported. |

|