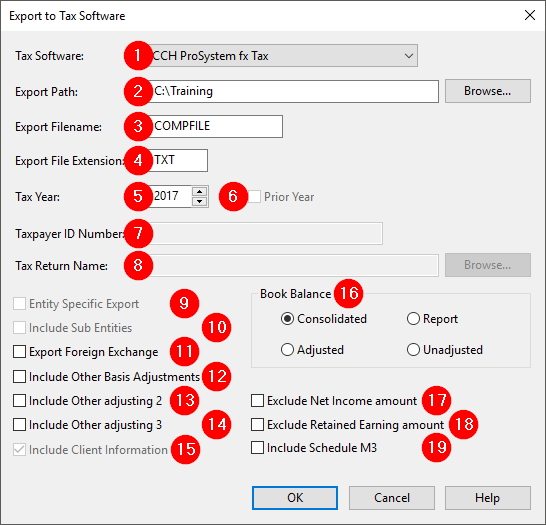

Export to Tax Software Dialog (US)

| Number | Description | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

|

|

Tax Software: Select the tax software to which you want to export. To export to a tax software in a different country, from the menu bar, select Engagement | Properties and in the Tax Jurisdiction drop-down, select the appropriate country For instructions on exporting, select from the drop-down: |

||||||||||

|

|

Export Path: Type or click Browse to select a location for the export file. |

||||||||||

|

|

Export Filename: Enter the name of the export file. Note: If exporting to CCH ProSystem fx Tax, do not change the default filename of COMPFILE. |

||||||||||

|

|

Export File Extension: Displays the file extension of the export file. The file extension is automatically completed based on the tax package selected in the Tax Software drop-down.

Note: "6" denotes a 2006 tax year file. Change the number as needed to represent the tax year, for example "5" for a 2005 tax year file, and so on. |

||||||||||

|

|

Tax Year: Displays the tax year of the client file as specified in the Engagement Properties dialog. Use the arrows to change the tax year. |

||||||||||

|

|

Prior Year: Select to include prior year data. Note: Prior year data such for calculation of tax deductions for fixed assets depreciation under the MACRS are exported even if this check box is not selected. |

||||||||||

|

|

Taxpayer ID Number: Enter the Taxpayer Identification Number (TIN) used when filing the tax return. |

||||||||||

|

|

Tax Return Name: Enter or click Browse to locate the tax return file to which information should be exported. |

||||||||||

|

|

Entity Specific Export: Select to export information about a single entity only. Only available in consolidated client files. If selected, the Entity Selection dialog displays once OK is clicked. |

||||||||||

|

|

Include Sub Entities: Select to export associated sub entities along with the entity. When selected, a consolidated total of the parent company and its subsidiaries is exported. Note: The parent company name and address will be included for all tax exports. If exporting entity specific data from a consolidated file, company name and address for sub entities must be modified in the tax software once data has been imported. |

||||||||||

|

|

Export Foreign Exchange: Select to convert a foreign tax balance to the default currency before exporting. A foreign exchange rate applies to opening balances, transaction amounts, and tax adjustments posted to accounts. Notes:

|

||||||||||

|

|

Include Other Basis Adjustments: Select to include other basis adjustments in exported balances. |

||||||||||

|

|

Include Other adjusting 2: Select to include other adjusting 2 entry types in exported balances. See Create Extra Adjusting Entry Types for more information. |

||||||||||

|

|

Include Other adjusting 3: Select to include other adjusting 3 entry types in exported balances. See Create Extra Adjusting Entry Types for more information. |

||||||||||

|

|

Include Client Information: Select to include client information (Engagement | Properties) in the export. |

||||||||||

|

|

Book Balance: Select the type of book balance to include in the export.

|

||||||||||

|

|

Exclude Net Income Amount: Select to exclude the Net Income from the export. Note: This ensures that the net income does not override the net income from the CCH tax file. |

||||||||||

|

|

Exclude Retained Earning Amount: Use this option to exclude the Retained Earnings amount in the export. Note: This ensures that the R/E (L24) does not override the R/E in the CCH tax file. |

||||||||||

|

|

Include M3 Schedule: Use this option to export the M1 or M3 schedule separately. |