Exporting to Lacerte Tax

Prerequisites

- Set the Tax Jurisdiction, Tax Entity, and Tax Vendor information in the Engagement Properties dialog. >>How Do I?

- Assign tax export codes to accounts or enter the relevant codes in the Tax Code column of the Working Trial Balance | Tax tab. >>How Do I?

-

After a year-end close, review the tax codes assigned for any now obsolete tax codes so they can be reassigned to active tax codes instead.

Working Papers updates the program for available tax codes every year.

-

There were no changes to tax codes in the 2016 tax year.

Procedure

-

Open the Working Papers client file from which you would like to export.

-

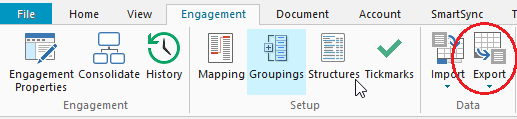

On the Engagement tab, in the Data Group, click Export | Tax Software.... The Export to Tax Software dialog will open.

-

From the Tax Software drop-down, select Lacerte Tax.

-

Complete the remaining fields of the dialog. >>Quick Reference

-

Click OK to process the export. If there are any errors or problems during export, an export log file appears. Review the log and resolve the issues before rerunning the export.

Results

Working Papers creates export files that follow the format yyyy.xBn, where...

- yyyy represents the name entered in the Export Filename field,

- x represents the tax entity code, and

- # represents the last digit of the tax year

The file can now be imported into Lacerte Tax. >>How Do I?

Note: The top-level company name and address will be included for all tax exports. If you are exporting entity-specific data from a consolidated file, you will need to modify the company name and address in the tax package once the import to the tax package is complete.