Assigning Tax Codes

Procedures

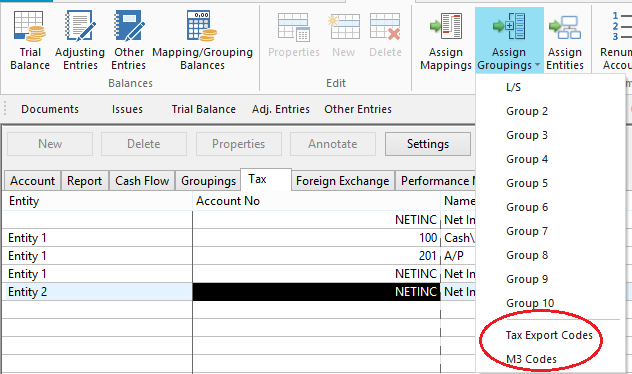

- On the Account tab, in the Assign group, click Assign Groupings and select Tax Codes.

- Select an account in the Unassigned Accounts pane and then select a corresponding tax code in the Tax Codes pane.

- Click Assign.

- Click Apply to save the changes.

Results

Tax Codes are assigned to applicable accounts. Assigned accounts will display a plus button ( ).

).

Notes

- The available tax codes vary depending on the type of tax entity and the tax jurisdiction of the client file. >>How Do I?

-

M3 codes may also be assigned to the chart of accounts. There are four types of M3 Tax Codes, designated by a letter suffix. A codes represent M3 Book Amount, B codes are Temporary Amount, C codes are Permanent Amount, and D codes are Tax Amount. Not all tax vendors support D codes, and users should usually not export them.

M3 codes may also be assigned to the chart of accounts. There are four types of M3 Tax Codes, designated by a letter suffix. A codes represent M3 Book Amount, B codes are Temporary Amount, C codes are Permanent Amount, and D codes are Tax Amount. Not all tax vendors support D codes, and users should usually not export them. -

To remove accounts from a tax code, select the account in the right-hand box and then click Unassign.

-

Additionally, you can assign tax codes to accounts from the Working Trial Balance Account or Tax tabs. Find the applicable account and scroll across until you find the Tax Code column. Click in the corresponding cell to select the tax code.

-

For those tax codes marked with an * in the tax code list, you can define sub codes and assign accounts to those sub codes. If using sub codes, however, do not assign an account to the top-level tax code or there may be problems during the export of information. If the tax code has no user-defined sub code, an account can be assigned to it with no problem.