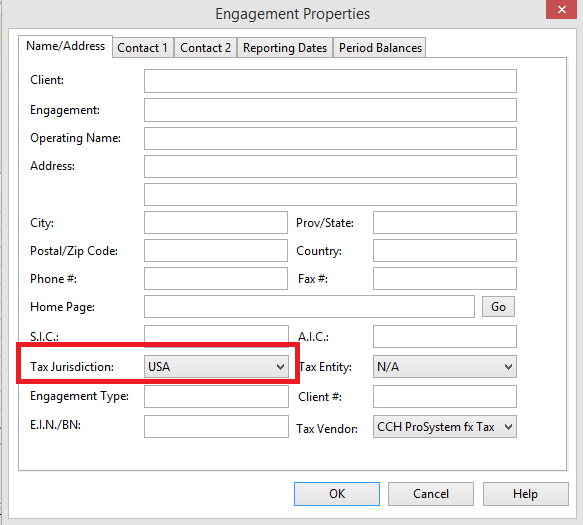

Specifying Tax Information

Procedures

- On the Engagement ribbon, click Engagement Properties.

-

In the Tax Jurisdiction box, select the tax jurisdiction for the client from the drop-down list.

-

In Tax Entity, select the appropriate tax entity for the client file.

- In Tax Vendor, select the appropriate tax vendor for the client file.

Results

Working Papers will populate tax information based on the Jurisdiction and Entity selected. This includes such as available tax packages to export and codes.

Notes

-

When the tax entity selection is changed and the "Autofill tax codes" query is answered with a yes, Working Papers populates the tax codes with entity-specific codes linked through the mapping numbers. If there is no entity-specific tax code for a map number then the generic tax code is used if available. If not available (i.e., blank) then the autofill procedure leaves the current tax as is.