Automation of risk assessments and audit responses

Your firm author can enable the automation of risk assessments and audit responses in the Financial Statement Areas (FSA) worksheet and Risk dialog to increase workflow efficiency. When enabled, the Audit template automates the following:

| Risk Assessment | FSA worksheet | Risk dialog |

|---|---|---|

| Inherent Risk |

|

|

| Control Risk |

|

|

| Risk of Material Misstatement |

|

|

| Audit Response |

|

N/A |

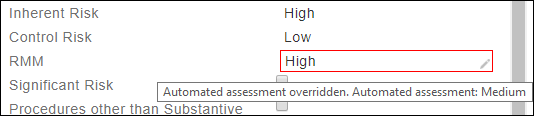

Note: If you override the automated assessment in the FSA worksheet, it will display with a red border and tool-tip that includes an audit trail with the original assessment.

Automated risk assessments

Your firm author can automate the assessment of a FSA item's Inherent Risk, Control Risk and Risk of Material Misstatement (RMM). In an engagement file, users can load the automated values into the FSA worksheet. Under the Inherent Risk, Control Risk, and RMM columns, select *Proposed from the drop-down menu. Reference the chart below for a summary of how automated assessments are determined.

| Risk assessment | Determination of automated assessment | Automation with conflicting assessments |

|---|---|---|

| Inherent Risk (IR) | Based on risks associated to the FSA item | The automated Inherent Risk is the highest Inherent Risk assessment |

| Control Risk (CR) | Based on the Control Risk assessment of the business cycles associated to the FSA item | The automated Control Risk is the highest Control Risk assessment |

| Risk of Material Misstatement (RMM) |

Based on IR and CR assessment, if complete OR; Based on risks associated to the FSA item, if IR and CR are not complete |

N/A, there will never be a conflict OR; The automated RMM is the highest RMM assessment |

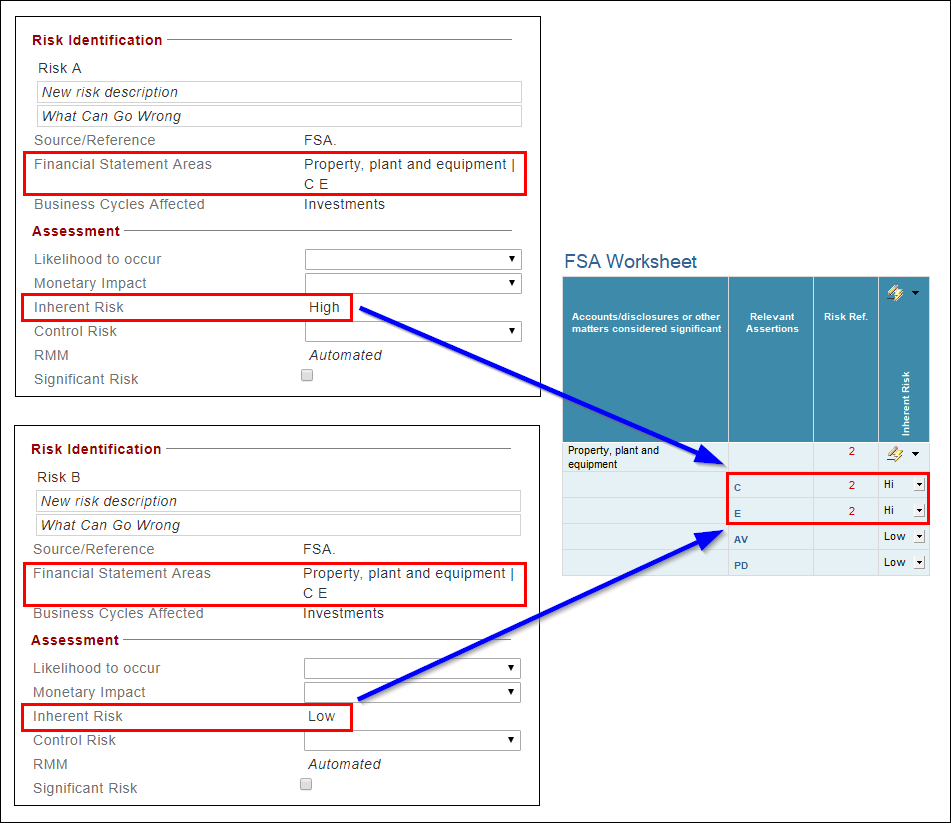

Automated Inherent Risks in the FSA worksheet

Automated inherent risks in the FSA worksheet are based on the Inherent Risk assessments of all risks associated with a FSA item. Each assertion of a FSA item is assessed independently, then the FSA worksheet pulls the highest Inherent Risk assessment into the automated inherent risk column for each associated assertion.

For example, if assertions C and E are associated to Risk A and Risk B, the Inherent Risk column will pull the highest assessment between the risks. If the inherent risk for Risk A is set to High and Risk B is set to Low, the FSA Inherent Risk column is automatically set to High for both C and E rows.

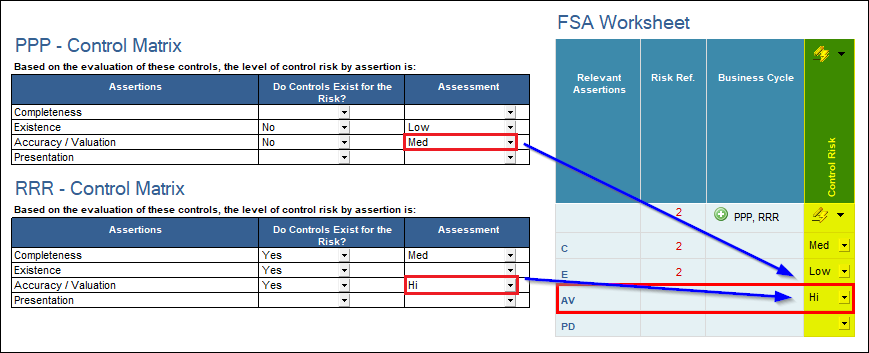

Automated Control Risks in the FSA worksheet

Automated control risks are based on the risk assessments of associated business cycles. In a business cycle's Control Matrix, each assertion is assessed independently, then the FSA worksheet pulls the highest control risk assessment for each assertion into the automated Control Risk column.

For example, if a FSA item is associated to Purchases, Payables, Payments (PPP) and Revenue, Receivables, Receipts (RRR), the FSA worksheet will pull the highest control risk assessment. In PPP, if assertion AV is set to Medium and in RRR it is set to High, then the FSA worksheet automatically sets the Control Risk column for assertion AV to High.

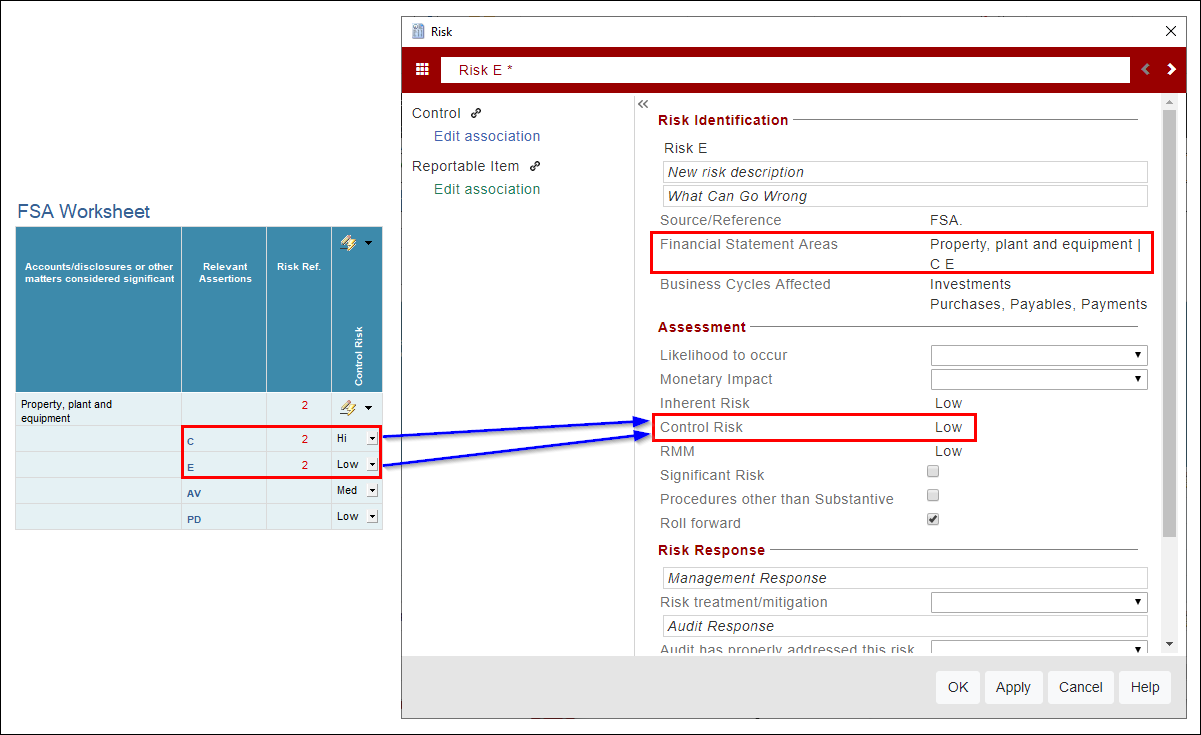

Automated Control Risks in the Risk dialog

The automated Control Risk assessment in the Risk dialog is determined by the control risks of associated FSA items. If there are multiple associated FSAs, the automated Control Risk will use the lowest control risk assessment. This ensures there are no risks with a higher control risk than the FSA item itself.

For example, Risk E is associated with assertions C and E. The automated Control Risk for C is High and Low for E. The Control Risk in the Risk dialog pulls the lowest assessment and automatically sets to Low.

Automated RMM assessments in the FSA worksheet

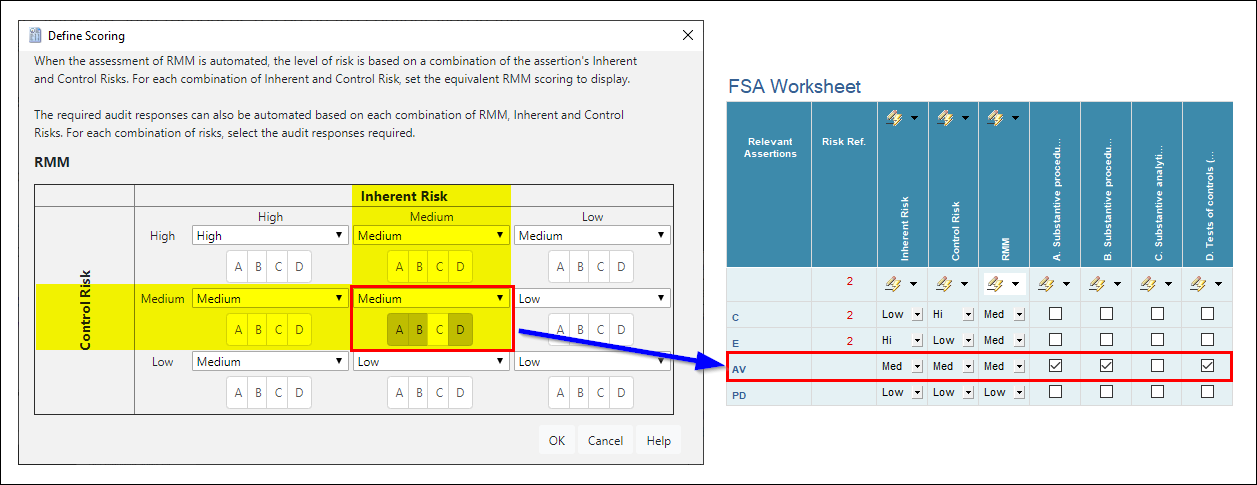

The automated RMM column in the FSA worksheet can be derived using two different methods. In the first method, template authors must enable both the Inherent Risk and Control Risk. If both risks are complete, the automated RMM is then based on the configuration in the Define Scoring dialog (AO - General options | Financial Statement Areas Worksheet).

For example, if assertion AV has an Inherent Risk set to Medium and a Control Risk set to Low, based on the configuration in the Define Scoring dialog below, the automated RMM is automatically set to Low.

.png)

In the second method, template authors must disable both the Inherent Risk and Control Risk options. The automated RMM in the FSA worksheet is based on the RMM assessments of all risks associated with a FSA item. Each assertion of a FSA item is assessed independently, then the FSA worksheet pulls the highest RMM assessment into the automated RMM column for each associated assertion.

For example, if assertions C and E are associated to Risk C and Risk D, the RMM column will pull the highest assessment between the assertions. If the RMM for Risk C is set to Low and Risk D is set to Medium, the FSA RMM column is automatically set to Medium for both C and E rows.

.png)

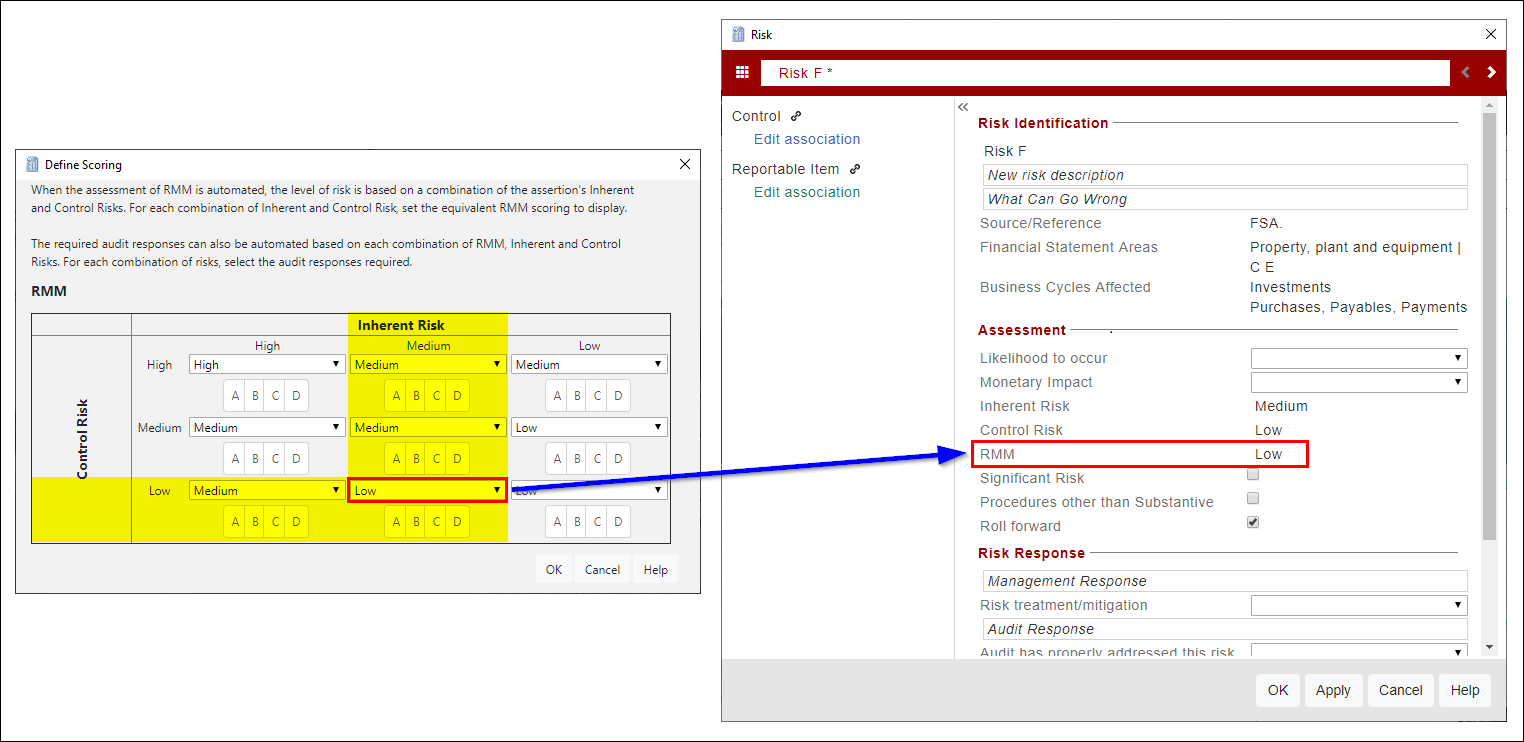

Automated RMM assessments in the risk dialog

Your firm author can automate the RMM assessment based on the configuration in the Define Scoring dialog (AO - General options | Financial Statement Areas Worksheet).

In the Risk dialog, the RMM assessment only automates if both the Inherent Risk and Control Risk fields are complete. RMM assessments always follow the Define Scoring configuration and cannot be defined differently for different risks.

For example, if Risk F has an Inherent Risk of Medium and a Control Risk of Low, based on the configuration in the Define Scoring dialog below, the RMM in the Risk dialog automatically sets to Low.

Automated risk responses in the FSA worksheet

After completing the risk assessment for a FSA item, you'll require an audit risk response. Your firm author can automate audit responses based on the configuration in the Defining Scoring dialog (AO - General options | Financial Statement Areas Worksheet).

Note: You must complete the Inherent Risk and Control Risk columns in the FSA worksheet to automate the risk response.

For example, if assertion AV has an Inherent Risk set to Medium and a Control Risk set to Medium, then the FSA item requires audit responses A, B and D.