Statement of Cash Flows Worksheet

Cash Flows Worksheet Components

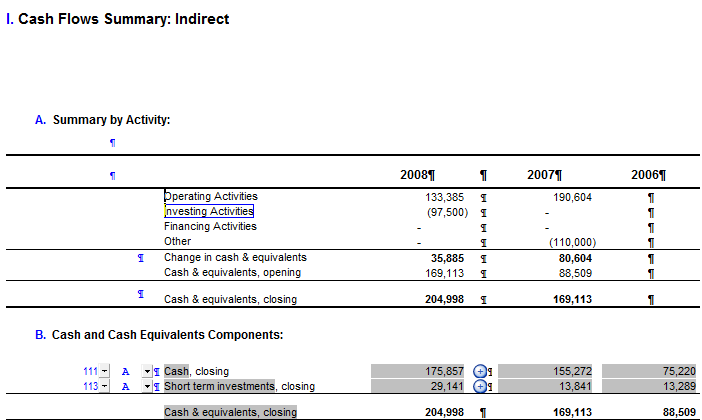

Cash Flows Summary

The cash flows summary serves as a compressed cash flows statement, to assist in ensuring that all the cash flows items are analyzed and the cash flows are in balance.

Note: The distinction of whether the direct or indirect method of cash flows is selected is printed at the top of the document. The default selection for the direct or indirect method is made in the Home tab.

The cash flows summary has two areas:

- A. Summary by Activity

- B. Cash and Cash Equivalents Composition

A. Summary by Activity

All calculations created in other parts of the worksheet are automatically transferred to this summary. Once the individual analysis items in Areas II through V are completed, the totals are transferred to this summary.

B. Cash and Cash Equivalents Composition

You are required to define the components of the ending balance for cash and cash equivalents. You can either select from the group number using the drop-down selection, or type the descriptions and balances.

You can modify the cash and cash equivalents composition table by adding, deleting or sorting rows and annotating them with references, tickmarks, and notes.

Cash Flows Areas

Up to five cash flows areas are available for the Statement of Cash Flows:

- II. Operating Activities

- III. Investing Activities

- IV. Financing Activities

- V. Other

- VI. Supplemental Data

Each cash flow area represents a section of the statement of cash flow and consists of multiple activity tables, with each table calculating a line item on the statement of cash flows. Each cash flows area operates in a similar manner.

Workflow

To complete the Statement of Cash Flows Worksheet, you must:

- Determine the appropriate reporting method

- Determine the number of items for analysis

- Perform the analysis

- Name the analysis

You must also ensure that the cash flow worksheet is balanced.

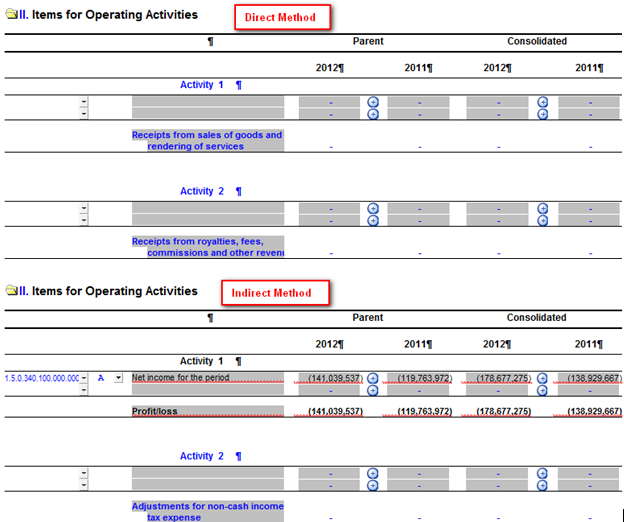

Determine the appropriate reporting method

The basic options for the cash flows worksheet are dependent on selections made in the Statement of Cash Flows tab in the financial statements. This includes the Direct or Indirect reporting methods and the various columns of data included. If your template author has the locked the presentation methods, only their selected cash flows method will be available.

The activities within the Operating Activities section change depending on the selection of Direct or Indirect method for reporting.

Determine the number of items for analysis

The analysis area is divided into five cash flows areas:

- II. Operating Activities

- III. Investing Activities

- IV. Financing Activities

- V. Other

- VI. Supplemental Data

Each cash flows area operates in a similar manner.

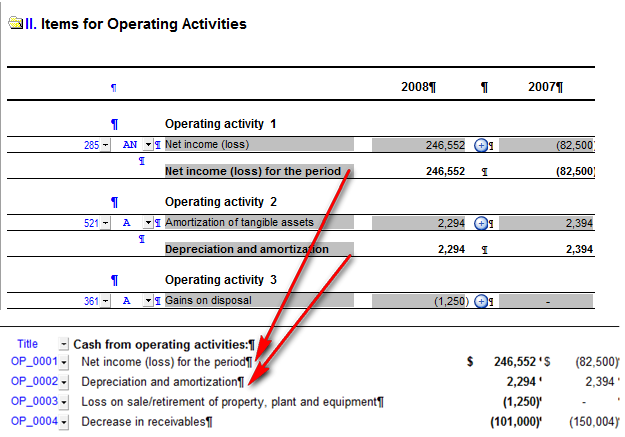

You should determine the number of analysis items required for a particular cash flows area. Each analysis item represents one line on the cash flows statement. For example, if Operating Activities is required to include three line items in the financial statements, create three analysis items in the Operating Activities area on the cash flows worksheet.

Up to 99 analysis items can be created in each cash flows area.

The cash flow worksheet is pre-populated with analysis tables based on the relevant XBRL taxonomy. For more information on taxonomies, see About XBRL.

Cash flows analysis items that have zero balances can be hidden if desired. This means that only the items that are currently used in a particular engagement are displayed, but ra complete list of possible cash flows disclosure items is still retained. The complete list can be easily displayed and reviewed to determine if any additional items are applicable to the particular engagement.

Perform the analysis

You can create any combination of accounts in the analysis table to support an individual cash flows item on the cash flows statement. You can select an account from the mapping structure or the mapping number may be left blank, allowing you to input data in all fields.

If you select a mapping number, there are six alternative property views for the selected account. See Alternative property views for a list of these views. Note that if you are using the budget column, the information must always be input.

You can also modify a cash flows analysis table by adding, deleting, or sorting rows and annotating them with references, tick marks, and notes.

Name the analysis

Each analysis item should have a unique name. This name is added to the database and can then be accessed in the financial statements. Examples of names include "Cash receipts from customers", "Interest payments", and "Proceeds on long-term debt". Names are created for the more common lines that appear on cash flows statements. These names can be changed as required.

Note that if the name is not completed, it appears as a blank description item when preparing the financial statements.

Supplemental data

In the financial statements, the cash flows formats include a supplementary analysis at the bottom of the cash flows statement to complete the total for Cash and Cash Equivalents. You are required to define the items that make up the total of Cash and Cash Equivalents. This analysis is useful when creating rounding relations.