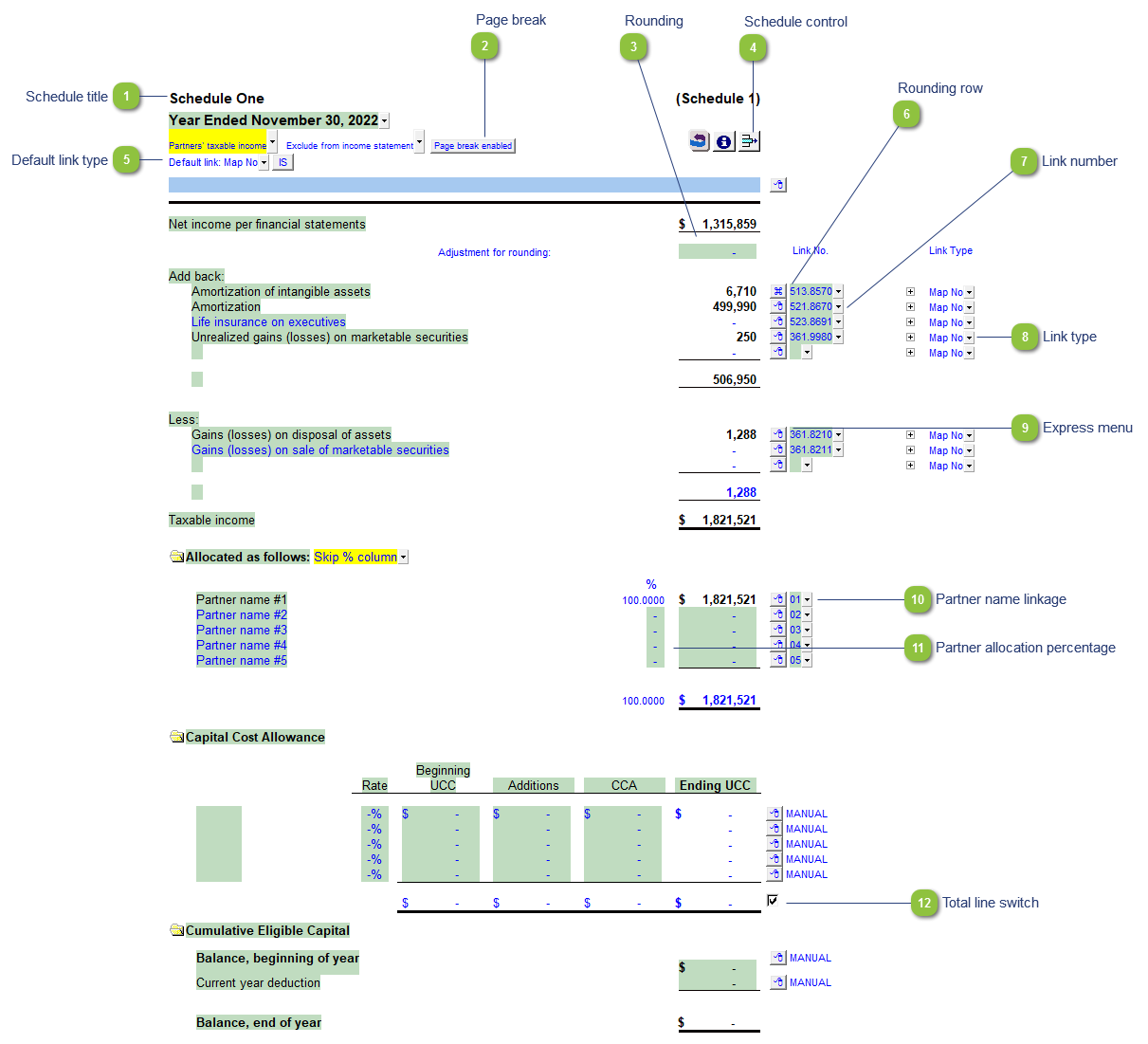

Partner's Taxable Income Schedule

| Number | Name | Description |

|---|---|---|

|

Schedule title |

Customizable schedule title which appears at the top of the schedule and on the Index Page |

|

Page break |

Select if the page break should be enabled at the top of the schedule. |

|

Rounding |

Enter amounts for rounding of the schedule if needed. The rounding amounts will be plugged into the designated rounding line which is indicated by

|

|

Schedule control |

Left-click the button to delete the schedule. Right-click the button to reload the schedule from the Resource Centre. |

|

Default link type |

Select the default grouping you want to use for the schedule linkage. The schedule is defaulted to use the Map No link. |

|

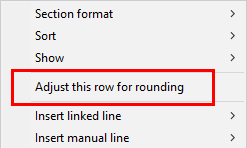

Rounding row |

To apply the rounding difference to a row, right-click on the express menu and select Adjust this row for rounding.

|

|

Link number |

The link number indicates which linked number (i.e. map number) the row is linked to. Use the popup menu to select a link number. This can be a map, account or group number depending on the link type selected. Refer to Balance Origins for more information. |

|

Link type |

The link type is set from the default link type selected. You can change the link type for the individual row item if different from the default link type. |

|

Express menu |

Right-click on the express menu to insert more linked or manual lines, insert subtotals, sort and delete current lines where the options are available. |

|

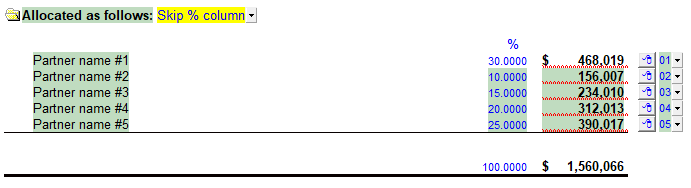

Partner name linkage |

Partner name pulled from the descriptions entered into mapping numbers 280.0001 - 280.0030 |

|

Partner allocation percentage |

Allocate a percentage of the calculated taxable income between the various partners. The percentage allocated for Partners 2 onwards will be deducted from the first partner to ensure that total allocation always remains at 100%

|

|

Total line switch |

Select for the total line to print or skip. |

. Right-click on a line for the option to designate the row for rounding.

. Right-click on a line for the option to designate the row for rounding.