Financial ratios

Working Papers includes four types of predefined financial ratios that update automatically based on the data in your Working Papers file.

These financial ratios are calculated using the ratio classes from the Trial Balance and Mapping database.

Liquidity ratios

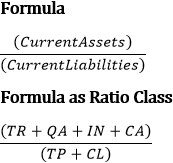

L1: Current ratio

Measures a company's short-term liquidity and its ability to meet current obligations when due. The higher the ratio, the greater the "cushion" between current obligations and the company's ability to pay them.

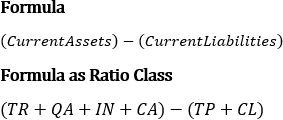

L2: Working capital

Measures the excess of current assets over current liabilities. It denotes the amount of assets expected to be converted to cash or consumed within one year beyond those used to pay current obligations. The amount is useful in performing a trend analysis on the company.

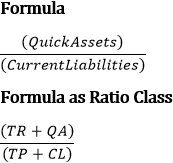

L3: Quick ratio

Measures the degree to which current obligations are covered by the most liquid current assets. Usually a value less than two implies a dependency on inventory or other current assets to liquidate short-term debt. Also known as the Acid-Test.

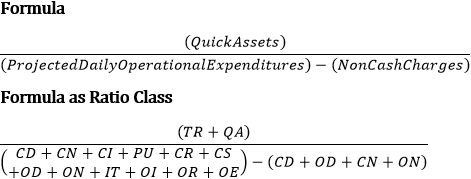

L4: Defensive interval days

Measures the length of time a company can operate on present liquid assets without resorting to revenues from next year's sources.

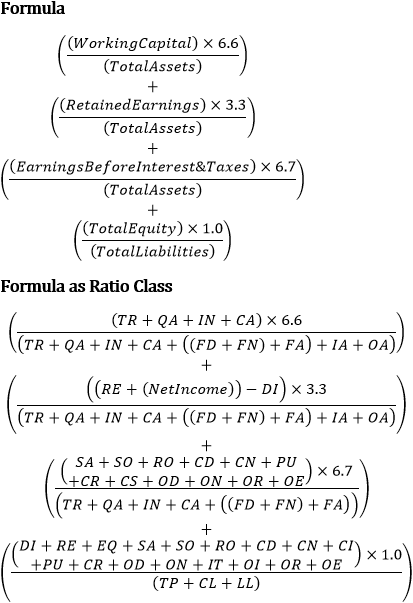

L5: Altman Z score

A numerical ranking that predicts the bankruptcy potential of a company. Z-scores below the threshold value of 2.6 indicate that the overall financial condition of a company is such that continued existence may be in question. Z-scores below 1.8 indicate that there is a strong potential for bankruptcy within the next two years.

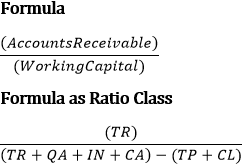

L6: Accounts receivable to working capital

Measures the dependency of working capital on the collection of receivables.

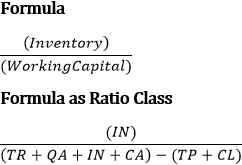

L7: Inventory to working capital

Measures the dependence of working capital on inventory and sales. A high inventory to working capital ratio means that a slump in sales could create serious cash flow problems.

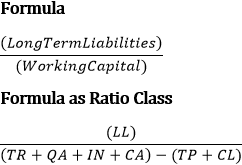

L8: Long term liabilities to working capital

In conjunction with other ratios, this ratio measures the degree to which long-term borrowings have been used to replenish working capital versus fixed asset acquisition. A high ratio may indicate that the company has reached its borrowing limit and should look toward equity financing. A low ratio may indicate an opportunity to convert short-term into long-term borrowing during periods of favorable interest rates.

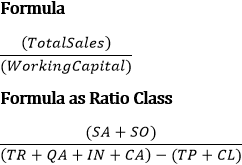

L9: Sales to working capital

In conjunction with the Inventory to Working Capital Ratio, this ratio indicates the degree to which working capital is dependent on sales.

Activity ratios

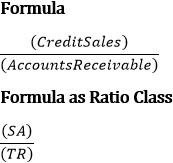

A1: Accounts receivable turnover

Measures the number of times trade receivables turn over during the year. The higher the turnover, the shorter the time between sale and cash collection.

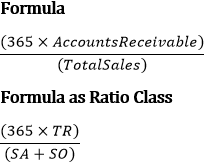

A2: Days sales in receivables

Measures the average length of time receivables are outstanding. Helps determine if potential collection problems exist.

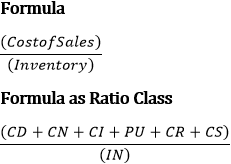

A3: Inventory turnover

Measures the number of times inventory turns over during the year. High turnover can indicate better liquidity or superior merchandising. Conversely, it can indicate a shortage of needed inventory for the level of sales. Low turnover can indicate poor liquidity, overstocking, or obsolescence.

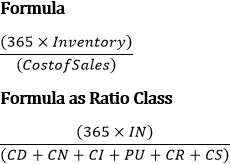

A4: Days cost of sales in inventory

Measures the average length of time units are in inventory. Helps determine if inadequate or excess inventory levels exist.

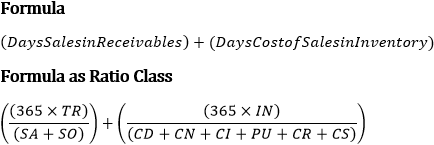

A5: Operating cycle days

Measures the time it takes to convert products and services into cash. An unfavorable trend may be a leading indicator of future cash flow problems.

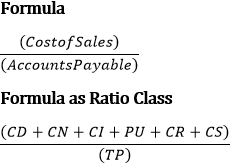

A6: Accounts payable turnover

Measures the number of times accounts payable are converted to cash each year.

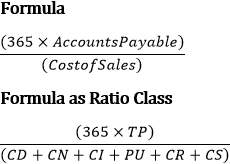

A7: Days cost of sales in payables

Measures the average age of accounts payable and indicates the bill-paying pattern of the company.

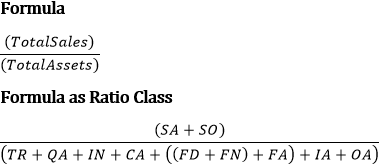

A8: Asset turnover

Measures the efficiency with which the company is able to use its assets to generate sales. The higher the turnover, the more efficiently its assets have been used.

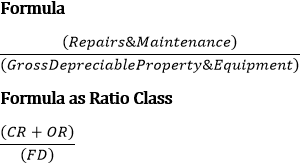

A9: Repairs & maintenance to gross depreciable property & equipment

Expresses the relationship of repairs and maintenance to gross property and equipment. Percentages outside of normal ranges could indicate classification errors in amounts capitalized. High percentages can indicate older property and equipment with needs replacement.

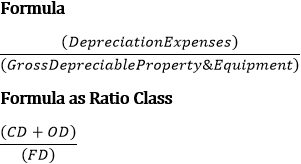

A10: Depreciation expense to gross depreciable property & equipment

Measures the rate at which productive asset costs are allocated to operations.

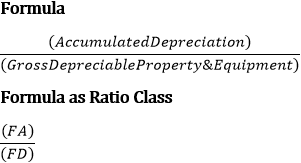

A11: Accumulated depreciation to gross depreciable property & equipment

Shows the cumulative percentage of productive asset costs allocated to operations. A high percentage usually indicates older property and equipment. Significant capital investment may be required in future periods

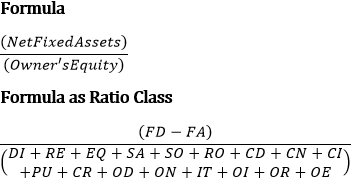

A12: Net property & equipment to owner's equity

Measures the extent to which investors' capital was used to finance productive assets. If this ratio is below 1, owners' investment may not have been used to generate future profits.

Profitability ratios

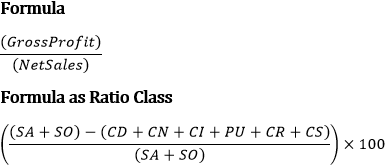

P1: Gross profit margin

Indicates how much of each sales currency is available to cover operating expense and contribute to profit.

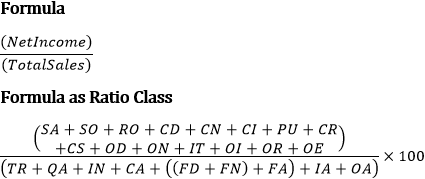

P2: Net profit margin

Measures how much of each currency of sales was converted to profit.

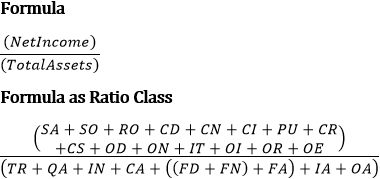

P3: Return on asset

Measures the ability to generate profits by additional investment in productive assets.

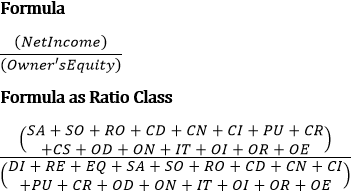

P4: Return on investment

Measures each sales currency's benefits to owners.

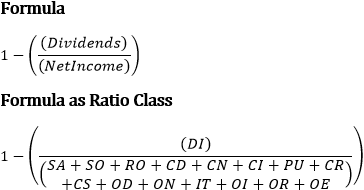

P5: Retention ratios

Measures the percentage of net income retained for future growth and expansion. Affects cash flow and future growth potential.

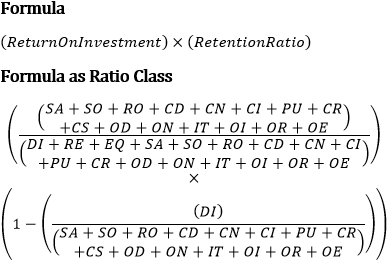

P6: Potential growth ratio

Computes maximum future growth rate based on current results.

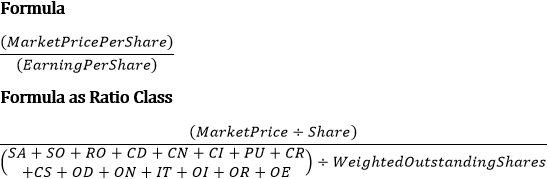

P7: Price earnings ratio

This ratio is not directly controllable by management, but is important to investors and can have a big impact on future financing needs and alternates. A stable trend in net income generally results in a higher price earnings ratio.

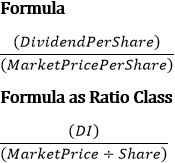

P8: Dividend yield

Measures the cash flow return to investors, based upon the dividend declared against the cost of the investment as indicated by the market price per share.

Coverage ratios

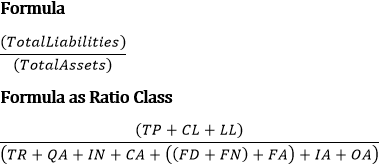

C1: Debt ratio

Measures the portion of total assets provided by the company's creditors. In conjunction with other ratios, this ratio indicates the degree to which operating losses may be "cushioned" from adverse actions by creditors.

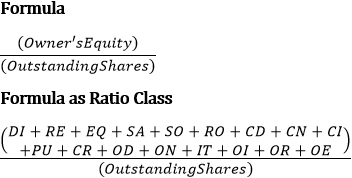

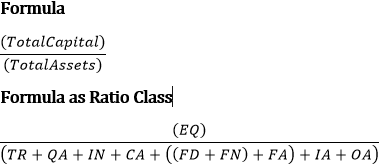

C2: Owner's equity

Measures the portion of total assets provided by the company's investors. In conjunction with other ratios, this ratio indicates the degree to which operating losses may be "cushioned" from adverse actions by investors.

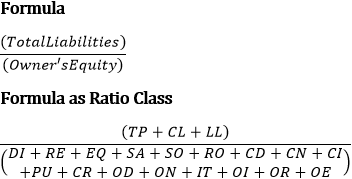

C3: Debt to equity ratio

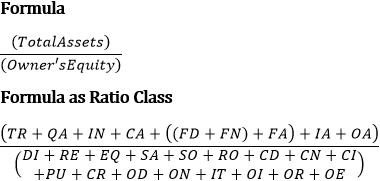

C4: Financial leverage index

Indicates the extent to which the owners have leveraged their investments. This is the reason for the difference between the return on assets ratio and the return on equity ratio.

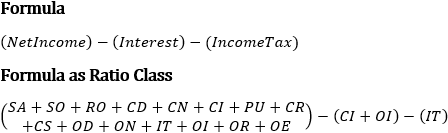

C5: Earnings before interest

Measures the operating profit of a company before the effects of financing costs and income taxes. This is a meaningful indicator that has comparability with other companies because it excludes the effects of capitalization (i.e. debt and equity financing).

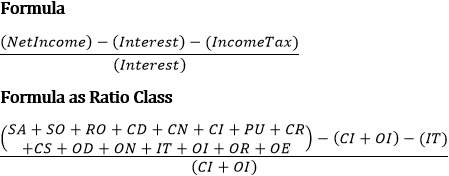

C6: Times interest earned

Measures the company's ability to pay its contractual interest payments. Also indicates the extent to which financial leverage had a positive or negative effect on net income.

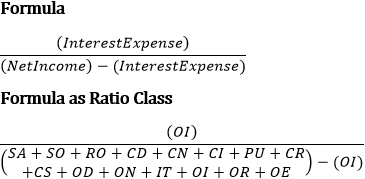

C7: Interest to net income before interest

Measures the effect of leverage on net income.

C8: Book value per share

Reflects value per share available to owners based on historical costs. Does not reflect the effect of inflation.