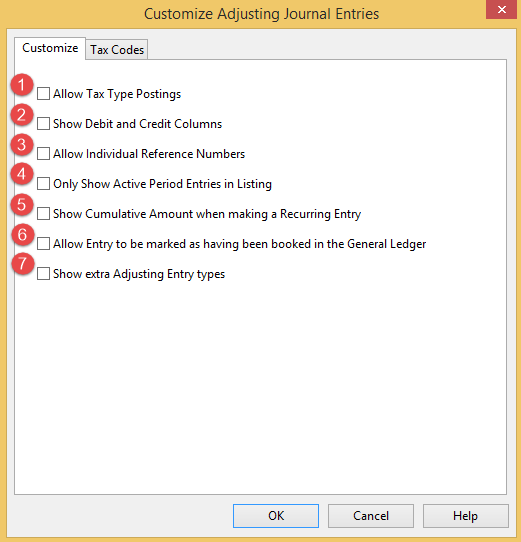

Customize Adjusting Journal Entries Dialog

Use this dialog to customize the appearance and function of the Adjusting Journal Entry screen.

Customize tab

| Number | Option | Description |

|

|

Allow Tax Type Postings |

Select to have the ability to enter tax amounts in the journal entry. Selecting this option applies several changes to the journal entry:

Amounts entered into the Tax amount column are automatically calculated based on the amount in the total column and the tax code entered into the tax code column. Note: Clearing this option will not eliminate any existing tax entries. The tax code amount can be changed to 0% to eliminate future posting of tax amounts. However, changing the tax code affects all entries that reference the tax code changed. |

|

|

Show Debit and Credit Columns |

Select to display both debit and credit columns on the adjusting journal entry dialog. The Account column is hidden allowing entry of credit and debit amounts into two separate columns. Tip: Clear this check box to treat positive amounts as debits. Credit amounts must be preceded or followed by a minus (-) sign. |

|

|

Allow Individual Reference Numbers |

Select to add a column to the adjusting journal entries screen allowing the individual reference numbers to be modified for each line of the journal entry. |

|

|

Only Show Active Period Entries in Listing |

Select to restrict the entries that show in the Current Entry drop-down list to display only those entries that pertain to the current selected period. When cleared, all entries show in the Current Entry listing. |

|

|

Show Cumulative Amount when making a Recurring Entry |

Select to display a column that shows the cumulative amount of the adjustments booked for each account for that particular recurring entry. The amounts showing in the cumulative column reflect the balances from all instances of the recurring entry up to and including the entry being displayed, but not subsequent instances of the entry. If applicable, the cumulative adjusting amount can also be typed into this column and Working Papers will calculate the Total amount for the period, taking into account any existing prior period entries. Subsequent instances of the recurring entry will have the amount in the Total Amount column updated automatically. |

|

|

Allow Entry to be marked as having been booked in the General Ledger |

Select to display the Entry Booked in General Ledger check box in the Adjusting Journal Entries Screen. |

|

|

Show extra Adjusting Entry types |

Select to display two additional normal adjusting entry booking types that entries can be posted to. These types appear independently (separate columns) on the trial balance and grouping automatic documents. The description and abbreviation for each of these types can also be customized here. For more information about creating extra adjusting entry types, see Creating Extra Adjusting Entry Types. |

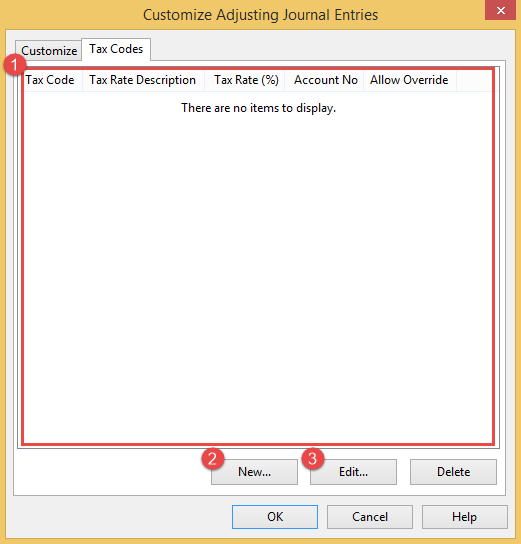

Tax Codes tab

| Number | Dialog section | Description |

|

|

Tax Code List |

Displays information about the tax applicable to Adjusting Journal Entries. This is useful for automatic calculations of any Tax type (including GST, PST, or HST), or any other type of tax calculation. An unlimited number of tax codes can be added. |

|

|

New Tax Code dialog button |

Opens the New Tax Code dialog which can be used to create a new tax code applicable to a certain journal. |

|

|

Edit a Tax Code dialog button |

Opens the Edit a Tax Code Dialog which can be used to edit an existing tax code applicable to a certain journal. |