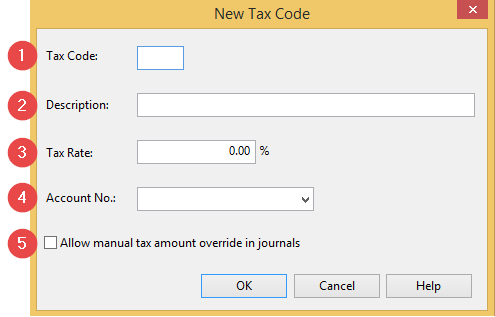

New Tax Code Dialog

| Number | Screen Element | Description | ||||||||

|

|

Tax Code |

Enter a code to identify the tax. The code can be 1 to 4 characters and may be changed as necessary. |

||||||||

|

|

Description |

Enter a description for the tax code. Descriptions may be up to 35 characters long. |

||||||||

|

|

Tax Rate (%) |

Enter the applicable rate for the tax. |

||||||||

|

|

Account No. |

Enter or select the account number from the drop-down list to assign tax to an account number. To access this list quickly, press F8. Note: If the tax rate is changed, all existing journal or adjusting entries using the tax code will be updated for the new amount. If you do not want this to happen, create a new unique tax code for the new amount. |

||||||||

|

|

Allow manual tax amount override in journals |

Select to allow manual tax amount to be overridden in journals. If selected, the following rules apply:

Note: When a new tax code (TAX_ID) is selected from the list, the Tax amount is automatically recalculated based on the percentage of that Tax Id, and the period balance is recalculated. |