Creating an Adjusting Journal Entry

Procedures

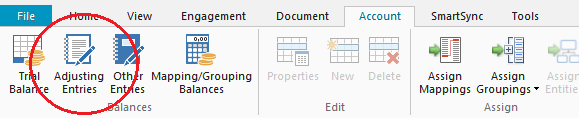

- On the Account tab, in the Balances group, select Adjusting Journal Entry.

- Fill in the applicable fields for your journal entry. >>Quick Reference?

- In the Adjusting Journal Entry worksheet area, Click

in the Number column to open the Type Letters for Quick Lookup dialog and select the account from the list. When working in a consolidated file, only accounts that pertain to the current entity display.

in the Number column to open the Type Letters for Quick Lookup dialog and select the account from the list. When working in a consolidated file, only accounts that pertain to the current entity display. - Type an amount. A debit amount should be typed with full decimals if necessary. A credit amount can be preceded or followed by a - (minus) sign and should be typed with full decimals if necessary.

Note: If you need to create a journal entry based on a calculation, see Creating a Calculated Adjusting Journal Entry.

Tip: You can create or edit a financial account on the fly by clicking New or Properties.

Results

The adjusting journal entry is posted and displayed as an editable entry. Any adjusting journal entry entered will display in the Adjustment column in Trial Balance documents.

Notes:

- Adjusting Journal Entries can also be created directly from the Working Trial Balance and automatic documents.

- You can remove a transaction line by clicking once on the transaction line and from the Edit menu, select Delete Line.

- Large numbers may not display properly due to their length. To correct the display problem do one of the following:

- On the Tools menu, select Options, then click Documents. Select the Display Whole Numbers check box; or

- On the Tools menu, select Font Settings and change your display font to a narrower font.

- To make the entry a recurring or reversing entry, select the correct radio button. To modify the pattern of recurrence, click Advanced and select the appropriate options.

-

Adjusting journal entries cannot be posted to calculated map numbers.If applicable, click Customize to add any additional options to the adjusting journal entry.

-

In a locked down file, only federal tax adjustments can be posted or modified.

-

You can post an adjustment to a map or group, but tax amounts are always posted directly to the tax account, rather than to a map or group number. When including tax amounts in any other entry posted to anything other than financial accounts, the Working Trial Balance will be out of balance by the tax amount.