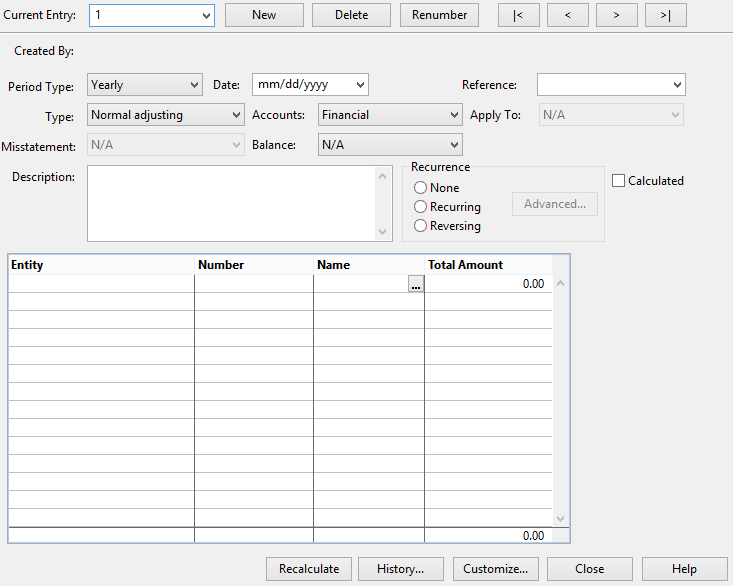

Adjusting Journal Entries Interface

Use this interface to input and edit adjusting journal entries.

Any transaction entered will appear in the Adjustment column in the Trial Balance document.

Access: On the Account tab, in the Balances group, select Adjusting Entry.

Click an area in the screen shot below to view its description

Click an area in the screen shot below to view its description

Other Options Available for Specific Settings

| Option | Description |

| Difference |

Select to create a temporary or permanent tax adjustment for the difference between tax and accounting balances. The Federal Tax adjustment amount will go to the Permanent or Temporary column of the corresponding Form, depending on the tax entity selected in the Engagement Properties dialog. Important: This option is only available if 'Tax - Federal' is selected as the type of adjustment and CCH ProSystem fx is selected as the Tax Vendor in the Engagement Properties dialog. |

| Entry Booked in General Ledger |

Select to have an entry only affect the specified period (interim balances) and not the adjustment amounts for the regular adjusting entry types. To enable this option, select the option to Allow Entry to be marked as having been booked in the General Ledger in the Customize Adjusting Journal Entries dialog. The entry amount will be reflected in the Working Trial Balance screen when drilling down to a Prior Year adjustment column and then further drilling down in the Adjustment column. The affected adjustment amount will display in the column labeled "Booked" in the Prior Adjustment screen. Note: If selected, account opening balances will not include booked adjusting journal entries from prior periods on the General Ledger report if the default date range is used. |

skip to the first,

skip to the first,  previous,

previous,  next, and

next, and  last journal entries) between adjusting entries.

last journal entries) between adjusting entries.

to enter a formula to calculate the value to be included in the Amount Field. Calculated entries can be useful for situations such as eliminating entries where users want to ensure the amount being eliminated reflects the most up-to-date value for the account.

to enter a formula to calculate the value to be included in the Amount Field. Calculated entries can be useful for situations such as eliminating entries where users want to ensure the amount being eliminated reflects the most up-to-date value for the account.  display the

display the

button to view more information for the selected adjusting journal history event. This dialog lists the date and time of the event, the name of the user who created or deleted the adjusting entry, and the description of the event. The description includes the entry number and when it was dated.

button to view more information for the selected adjusting journal history event. This dialog lists the date and time of the event, the name of the user who created or deleted the adjusting entry, and the description of the event. The description includes the entry number and when it was dated.