Defining Structures for Automatic Documents

To create structured automatic documents, the actual structure must be defined. Up to three structure definitions can be set up.

Procedures

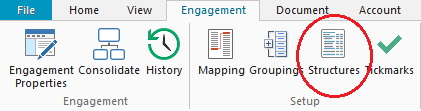

- On the Engagement tab, in the Setup group, click Structures.

- Select from the following types in the Type column:

| Type | Description |

|---|---|

| Section | A collection of groups/accounts. Displays the total of these groups and accounts. |

| Net Income | Provides a net gain or loss amount, which appears in the structured report. |

| Total | Provides a total of section lines that appear before the specific line. |

| Text | Allows the user to input text into a report. |

3. Fill in the remaining columns:

| Type | ID | Name | Calculation | Formatting |

| Section |

(Requried) ID that will be used in the total lines calculation. |

(Required) Displays the name of the financial statement category. |

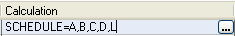

Specifies which groups/accounts appear in the section. For example,

where, "SCHEDULE" is the (leadsheet) grouping and "A,B,C,D,L" are group IDs for that group. Calculations may either be entered manually or by pressing the button and using the Section Setup dialog. |

(Optional) None, Single Underline, or Double Underline

|

| Net Income | (Mandatory) Used in the Total lines calculation | (Mandatory) Appears on the document | N/A | None, Single Underline, or Double Underline |

| Total | (Optional) Can be used for subsequent total calculations | (Mandatory) Appears on the document | Specifies how the total is calculated. For example, where CA, EQ, LL are IDs for Sections, Net Income, or Total Lines that appear before the current total line in the structure definition. Note: Forward referencing is not permitted - you cannot include items that appear after the current total line. Calculations may be entered manually or by pressing the button and using the Total Calculations dialog | None, Single Underline, or Double Underline |

| Text | N/A | (Mandatory) User-specified text that appears on the report | N/A | N/A |