Exporting to ProSeries (TurboTax)

Prerequisites

-

Unlike other tax exports, linking from the trial balance to the tax codes is done in ProSeries, not Working Papers.

-

For the latest Tax Code changes, see US Tax Year Export.

Procedure

-

Open the Working Papers client file from which you would like to export.

-

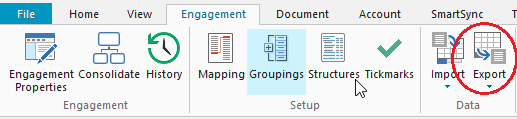

On the Engagement tab, in the Data Group, click Export | Tax Software.... The Export to Tax Software dialog will open.

- From the Tax Software drop-down, select ProSeries.

- Complete the remaining fields of the dialog. >>Quick Reference

- Click OK to process the export. If there are any errors or problems during export an export log file appears. Review the log and resolve the issues before rerunning the export.

Results

Working Papers creates a filename.ft file, where filename represents the name entered in the Export Filename field. Also, of note is are the balances included in the export. The four balances include:

- Adjusted book balance (includes the opening balance plus any non tax related adjustments from general, adjusting, eliminating or reclassifying journals).

- Adjusted book balance plus federal tax amounts

- Adjusted book balance plus state tax amounts

- Adjusted book balance plus both taxes' eliminating or reclassifying amounts

The file can now be imported into ProSeries. >>How Do I?

Note: The top-level company name and address will be included for all tax exports. If you are exporting entity-specific data from a consolidated file, you will need to modify the company name and address in the tax package once the import to the tax package is complete.