Configuring the statement of cash flows

You can specify options that control how the Statement of Cash Flows is configured. Options not defined here are included in Configuring common options.

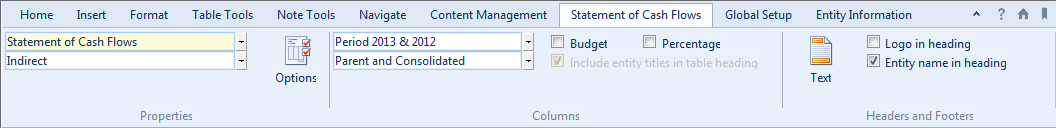

In Financials IFRS:

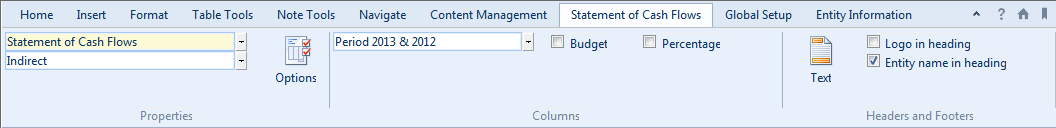

In Financials GAAP:

What do you want to do?

Specifying the cash flow reporting method

In the Statement of Cash Flows, you can specify whether to use the direct or indirect method of calculating cash flow. The default method may be defined by the template author. The method selected in the financial statements is reflected in the Statement of Cash Flows Worksheet.

Procedure

- Open the Financial statements document, click in the Statement of Cash Flows area, and select the Statement of Cash Flows tab.

- From the Cash flow method drop-down, select either Direct or Indirect.

Results

The specified presentation method is used.

Specifying Statement of Cash Flow Options

Financials provides you with the ability to print or hide cash flow components and other supplementary cash flow information.

Procedure

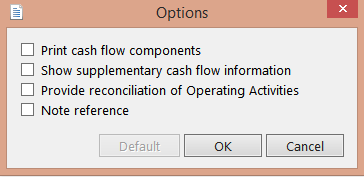

- Open the Financial statements document, click in the Statement of Cash Flows area, and select the Statement of Cash Flows tab.

-

Select

(Options). The Options dialog appears and select from the following available options:

(Options). The Options dialog appears and select from the following available options:

| Option | Description |

|---|---|

| Print Cash Flow Components | Select to include a table with cash components at the end of the cash flow statement in the published report. |

| Show supplementary cash flow information | Select to display additional supplementary information at the bottom of the cash flows statement. Upon selecting this option, four additional analysis sections are available at the bottom of the cash flows statement: |

| Provide reconciliation of Operating Activities | This option is only available for GAAP and when the presentation method is set to Direct. Select to display a reconciliation table of operating activities at the end of the cash flow statement. |

| Note Reference | Select to display note references in the statement of cash flow. |