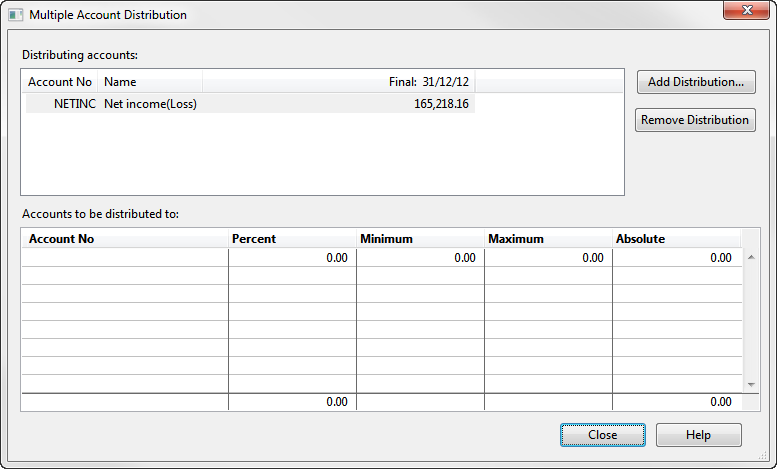

Multiple Account Distribution Dialog

If retained earnings are to be distributed to more than one account, the account numbers for Opening Retained Earnings must be specified in this dialog.

Enter the account numbers and applicable percentages for the distribution of retained earnings. Performing a Year End Close allocates the net income or loss to these accounts based on the percentages you input.

This dialog also allows each entity in a consolidated file to be treated individually. Each entity can have its own retained earning account defined.

Distributing accounts

The table displays information about accounts whose values are to be distributed to other accounts during the Year End Close. The NETINC account is specified by default.

In a consolidated file, each entity is listed as a line. Select each entity separately and make the appropriate changes.

Note: Split-up accounts cannot be distributed separately.

| Field | Description |

|---|---|

| Account information |

Account No - The Account Number as specified in the Chart of Accounts. Name - The name of the account as defined in the Chart of Accounts. Final - The year-end balance of the account. |

| Add Distribution | You can distribute balances from more than one account at a time. To add accounts from which to distribute balances, click Add Distribution. |

| Remove Distribution | To remove a distribution account, select the account in the table and click Remove Distribution. |

Accounts to be distributed to

Type or select the equity accounts to which you want to distribute the above balances. To delete an account from the list, select the line and press the DELETE key.

| Field | Description |

|---|---|

| Account No | Click to access the chart of accounts from which to choose. Type the first letter of the account, and the selection bar will automatically scroll to the item. |

| Percent | Performing a Year End Close allocates the net income or loss to these accounts based on the percentages you input. Therefore the percentages must total 100%. |

| Minimum | Enter an amount to specify a minimum balance to be used in calculating the percentage of the amount to be distributed to the new account. |

| Maximum | Enter an amount to specify a maximum balance to be used in calculating the percentage of the amount to be distributed to the new account. |

| Absolute | Enter an amount to specify an absolute balance to be used in calculating the percentage of the amount to be distributed to the new account. The remainder will be distributed to the other accounts designated for distribution. |

Note: The minimum, maximum and absolute numbers are used to calculate the percentage of retained earnings to be allocated to each account based on the current balance of the net income account selected. Once the calculation is completed, Working Papers does not use these amounts for any further calculations. If the retained earnings balances change in the future, the amount is not recalculated based on these amounts.

| Balance sheet | Type or select the account number that will include any rounding differences for the draft Balance Sheet. To ensure proper rounding, the account number used must be included in the main Balance Sheet. It should not be an account number included in a schedule. Control accounts can be used as rounding accounts, but depending on the Report setup, might not give the appropriate result. |

| Income statement | Type or select the account number that will include any rounding differences for the draft Income Statement. To ensure proper rounding, the account number used must be included in the main Income Statement. It should not be an account number included in a schedule. Control accounts can be used as rounding accounts, but depending on the Report setup, might not give the appropriate result. |

| Statement of cash flow | Type or select the account number that will include any rounding differences for the draft Statement of Cash Flow. To ensure proper rounding, the account number used must be included in the main Statement of Cash Flow. It should not be an account number included in a schedule. Control accounts can be used as rounding accounts, but depending on the Report setup, might not give the appropriate result. |

| Foreign Exchange | Type or select the account number you want to use to record the gain or loss resulting from the foreign currency translation. |

| To | |

| For balance calculations | |

| Include adjustments to | Selecting this option allows the inclusion of adjustments from maps/groups. When selected, adjustments to the chosen map/group are also rounded and included in the Rounding difference accounts. For Prior Years, you can choose to include the same map/group adjustments as selected for the Current Year. |