Year End Close and Roll Forward Dialog

The Year End Close and Roll Forward dialog controls the content to be included in the next year's file. The dialog is divided into following sections:

| Field | Description |

|---|---|

| File Path |

The path to the new file. If closing into the same file, choose the existing file location; a warning will appear prompting you to proceed with a backup of the file. The default path can be set in the Year End Close Path field specified under Tools | Options | Default Paths. |

| File Name |

The name of the client file. Use the Browse button to locate the new path and file name for next year's file. The arrow to the right of the Browse button allows specifications to be made whether to search for a folder or a file. Note: The maximum length for a client file name is 100 characters, including spaces but excluding any extension. The total file path + file name + extension (.ac_) maximum length is 254 characters. |

| Field | Description |

|---|---|

| Compress prior year file | Select to run a compression on the client file for this year once the new year's file is created. |

| Include BAK files | Select to include the BAK files in the compression of the prior year file. |

| Update prior year balance data |

Select to specify the current year balances for this year's file to become the prior year balances in the new year's file. This option has no effect on the current year column of the new file. With this option selected, other basis adjustments are rolled into the new year’s file. View the other basis adjustments by drilling down on the prior year column and then on the PY Adjustments column in the new year’s file. See Other basis adjustments for additional information. |

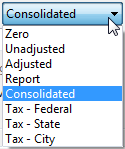

Update next year's opening balance data with: |

Select to close out the Income Statement to the retained earnings account number specified below in the Account Number box and to maintain the opening balances for the Balance Sheet in the new year's file. This is the preferred option if you are performing a monthly or yearly write-up engagement as the opening Balance Sheet numbers do not have to be entered. Note: Working Papers uses the final balance of the active reporting period for the opening balances, including cash flow accounts, in the next year's file. If eliminating entries exist in one of the reporting periods and you want them to be reflected in next year's opening, make sure the reporting period with the eliminating entries is active in the global period selector. Do not select this option if all Balance Sheet and Income Statement account balances are to be cleared to zero. This is the preferred option if you are performing a yearly engagement where you will be entering or importing the client's Balance Sheet and Income Statement end of year balances. The selection in the drop-down menu determines the type of balance to be used in the update.

R/E Account Number If electing to close out the Income Statement to retained earnings, the account number for Retained Earnings must be specified. Performing a Year End Close allocates the net income or loss to this account. Multiple Click the Multiple button if the retained earnings balance is to be distributed to more than one account. Click this button to allow different retained earnings accounts to be assigned for different entities in a consolidated file. |

| Roll forward Forecasts | Select if you want the next year's forecast amounts in the current file to become the current year forecasts in the new year's file. |

| Update current year Budgets with Forecast | Select if you want the next year's forecast amounts in the current file to become the current year budget amounts in the new year's file. |

| Update CaseView Roll Forward Cells |

Select to update input cells in CaseView documents with new values. This option is only applicable if Roll Forward options were specified for input cells in CaseView documents. CaseView cell calculations and linkage calculations to the accounting database update automatically. Note: This will also clear input paragraphs if the option to Clear contents on Roll Forward has been enabled in the paragraph properties. |

| Roll forward Budgets | Select if you want the current year budget amounts in the current file to become the prior year budgets in the new year's file. |

| Roll forward all Custom balances |

Select to roll forward custom balances based on whether the custom balance is set to current/past or current/future.

|

| Field | Description |

|---|---|

| Spreadsheet Analysis Data | Select to include any balances in spreadsheet analysis documents. Annotation of spreadsheets is included or excluded based on selections entered in the Annotations section. |

| Foreign Exchange and Program Assertion Info |

Select to include foreign exchange rates and/ or program assertion Information in next year’s file. Note: Prior year adjustments from Adjusting Journal entry balances are kept on a Year End Close and can be used when displaying reports. |

| Program Checklist Completion |

Select to keep the Yes/No, initials, and explanation columns for all programs and checklists. Document annotation, commentary references, and commentary text is included or excluded based on selections entered under Referencing. (Program and checklist procedural text is always copied to next year's file.) Note: This option applies only to Working Papers automatic documents. To roll forward input cells designated as roll forward cells in any CaseView documents included in the file, tick the option "Update CaseView roll forward cells". |

| Commentary Text | Select to include commentary text on all automatic documents (including text entered into memorandums) in next year’s file. |

| Outstanding Transactions | Select to specify roll forward options for journal entries. Selecting this check box will copy outstanding transactions into next year's file. |

| Account Number |

Select or type the account containing the outstanding transactions. Click Multiple if there is more than one account containing outstanding transactions. |

| Annotations |

Select annotation types to appear in next year’s file.

|