Posting Adjusting Journal Entries

Procedure

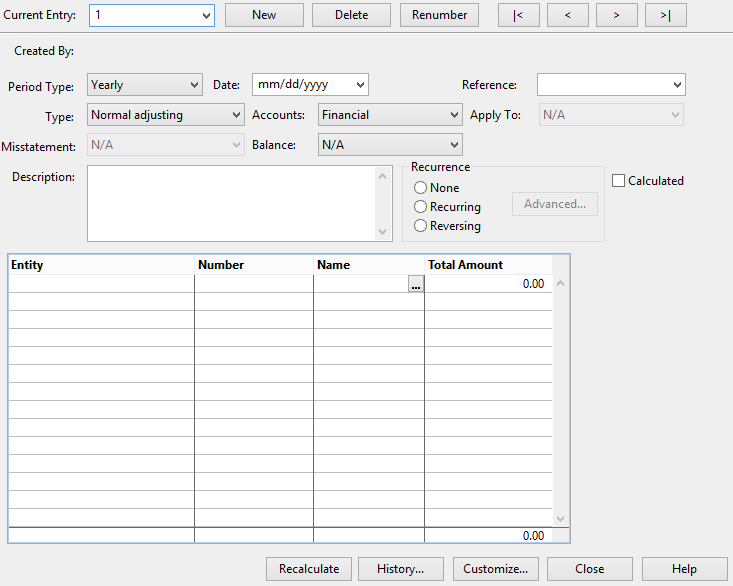

- On the Navigational toolbar, click Adj. Entries or from the Account menu, select Adjusting Journal Entries.

- Fill in the applicable fields for your journal entry.

- In the Adjusting Journal Entry worksheet area, Click

in the Number column to open the Type Letters for Quick Lookup dialog and select the account from the list.

in the Number column to open the Type Letters for Quick Lookup dialog and select the account from the list. - In the Total Amount column, enter an amount for the entry. A credit amount can be preceded or followed by a - (minus) sign.

Click an area in the screen shot below to view its description

Click an area in the screen shot below to view its description

Results

The adjusting journal entry is posted and displayed as an editable entry. Any adjusting journal entry entered will display in the Adjustment column in Trial Balance documents.

Notes

- You can remove a transaction line by clicking once on the transaction line and from the Edit menu, select Delete Line.

- Large numbers may not display properly due to their length. To correct the display problem do one of the following:

- On the Tools menu, select Options, then click Documents. Select the Display Whole Numbers check box; or

- On the Tools menu, select Font Settings and change your display font to a narrower font.

- To make the entry a recurring or reversing entry, select the correct radio button. To modify the pattern of recurrence, click Advanced and select the appropriate options.

- Adjusting journal entries cannot be posted to calculated map numbers.If applicable, click Customize to add any additional options to the adjusting journal entry.

- In a locked down file, only federal tax adjustments can be posted or modified.

- You can post an adjustment to a map or group, but tax amounts are always posted directly to the tax account, rather than to a map or group number. When including tax amounts in any other entry posted to anything other than financial accounts, the Working Trial Balance will be out of balance by the tax amount.

Comments and suggestions about this article and our software are greatly appreciated. As a user of our products, you are in a unique position to provide ideas that have an impact on future releases of this and other products.

Before contacting Technical Support, please consult the online Help and any other documentation included with this package as your first source to solve the problem.

If you require additional assistance, you can contact CaseWare® Technical Support by contacting your nearest CaseWare distributor.

When you contact CaseWare® Technical Support, you should be at your computer and have your documentation at hand. Be prepared to provide the following information:

- Your Client Number.

- The product version number, found by clicking the Help menu and selecting About.

- The type of computer hardware you are using.

- The software version number of MS-Windows.

- The exact wording of any messages that appear on your screen.

- A description of what happened and what you were doing when the problem occurred.

- A description of how you tried to solve the problem.

CaseWare Support

NORTH AMERICA

Email: support@caseware.com

Phone: 416-867-9504

GLOBAL

skip to the first ,

skip to the first ,  previous,

previous,  next, and

next, and  last journal entries) between adjusting entries.

last journal entries) between adjusting entries.  to enter a formula to calculate the value to be included in the Amount Field. Calculated entries can be useful for situations such as eliminating entries where users want to ensure the amount being eliminated reflects the most up-to-date value for the account.

to enter a formula to calculate the value to be included in the Amount Field. Calculated entries can be useful for situations such as eliminating entries where users want to ensure the amount being eliminated reflects the most up-to-date value for the account.

button to view more information for the selected adjusting journal history event. This dialog lists the date and time of the event, the name of the user who created or deleted the adjusting entry, and the description of the event. The description includes the entry number and when it was dated.

button to view more information for the selected adjusting journal history event. This dialog lists the date and time of the event, the name of the user who created or deleted the adjusting entry, and the description of the event. The description includes the entry number and when it was dated.