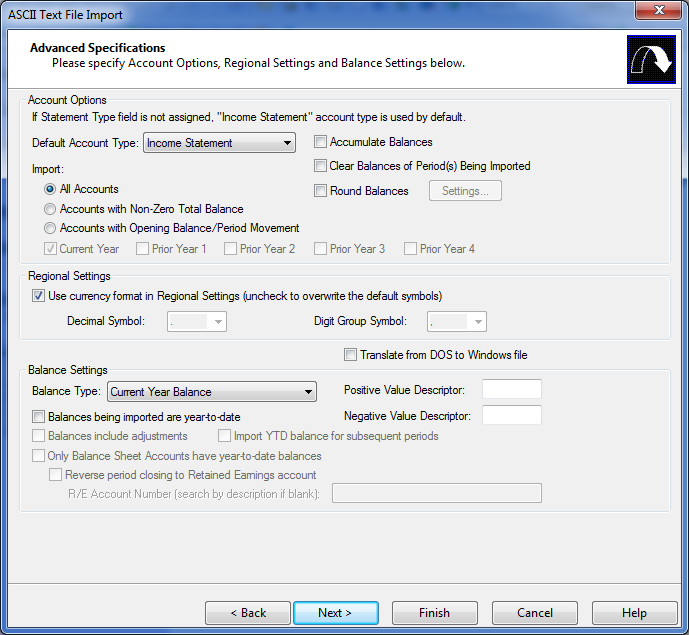

Advanced Specifications - Chart of Accounts & General Ledger Balances Import

When you are importing an ASCII text file or Excel file with the Chart of Accounts and General Ledger Balances selected as the import component, the Advanced Specifications screen opens with the following options:

Account Options

| Field | Description |

|---|---|

| Default Account Type | The default selection is Income Statement. If you want to assign accounts to the Balance Sheet, Cash Flow Statement, or Performance Measures Statement, change the selection. |

| Accumulate Balances | Select this option to have Working Papers combine the totals of any accounts that appear on multiple lines in the ASCII or Excel file. If there is an existing balance in the account prior to the import, those existing balances are overridden - not appended - to the import amount. This option works for prior, budget, and forecast balances as well as current balances. Note: You cannot combine this option with the "Balances being imported are year-to-date" option. If you attempt to select both options, you will receive a warning message prompting you to change one of the settings. |

| Clear Balances of Period(s) Being Imported |

Select to clear the period balances of all existing financial accounts for the period being imported prior to the import. By default, this option only clears balances for entities included in current import, and other entities will not be affected. If you want to apply this option to a certain entity, the imported data should contain at least one account for the specific entity so the import will include the entity selected. Notes

|

| Round Balances | Select this option to round the trial balance upon import. Click Settings to specify the rounding type and the accounts you would like to apply rounding to. |

| Import | Select the radio button describing the properties of the accounts to be imported.

|

Regional Settings

Use this area to customize the currency format for data imported from ASCII or Excel files. If no selection is made, Working Papers uses the Regional Settings in the control panel for decimal symbols and digit grouping symbols. This is most useful when you are preparing reports about foreign companies and organizations. If all your clients are domestic, then using the regional settings is recommended.

| Field | Description |

|---|---|

| Use currency format in Regional settings |

To override the regional settings, deselect this box and then select formats for the Decimal symbol and the Digit grouping symbol. To tell Working Papers to return to using the regional settings, select this check box. When using regional settings and working in any region that uses a (,) to separate units of currency, the (.) on the numeric keyboard is translated to a (,) on the screen. |

| Decimal symbol | Select either the period (.) or the comma (,) to separate units of currency. |

| Digit group symbol | Select either the comma (,) or the period (.) to group the digits in large currency values. |

Translate from DOS to Windows file

Select this option only if the ASCII or Excel file to be imported was originally exported from a DOS based application. This option allows translation between DOS and Windows special characters, such as special non-English characters. Selected text will be translated and show up correctly after import.

Balance Settings

| Field | Description |

|---|---|

| Balance Type | Select the type of balances being imported. |

| Positive Value Descriptor | If a special symbol is used to denote positive values, enter it in this field. |

| Negative Value Descriptor | If a special symbol is used to denote negative values, enter it in this field. |

| Balances being imported are year-to-date | Select if the balances to be imported are year-to-date numbers only.Note: You cannot combine this option with the "Accumulate Balances" option. If you attempt to select both options, you will receive a warning message prompting you to change one of the settings. |

| Balances include adjustments |

Select when importing year-to-date amounts to ensure that any existing adjusting entries in the file are taken into account when calculating the period movement amounts during the import. We advise there should be no adjustments to the period being imported to. |

| Import YTD balances for subsequent periods | Select this option if you are importing YTD balances to a range of periods within the current period date sequence and you do not want reversing transactions to be added to subsequent periods' YTD balance. If you select this option and you are importing into a blank file, all subsequent periods will have the same YTD balance as the last period imported. |

| Only Balance sheet accounts have year-to-date balances | Select if only the Balance sheet account numbers are YTD and all other accounts should be imported as per the preferences set above. This option is only enabled if Balances being imported are Year-to-date balances is selected. |

| Reverse Period closing to Retained Earnings account |

Select this check box in the following situations:

When importing periods where the income statements accounts have already been closed to the Retained Earnings account, this option can be used to reverse the prior period's net income out of the Retained Earnings account, so that the period movement amount for the income statement accounts import for each period while the balance sheet account's amounts are imported as year-to-date. Working Papers calculates the amount and manually adjusts for this amount in the Retained Earnings account. Notes

|

| R/E Account Number |

Enter the number for the retained earnings account that should be used to reverse the above entries. If blank, Working Papers will search by description. |